Comprehensive Financial protection packages tailored to you, your family’s or your business needs

Financial Policies are there for when you need them the most

There are many different types of policies designed to cover many different areas.

As Independent Financial Advisers we can research the whole of market to find you, your family, or your business the best provider, policy, and cover for your needs.

We all dream of winning the lottery. But what are your odds when it comes to accidents or illness?

Unfortunately, the chances of long-term absence from work are higher than you might think

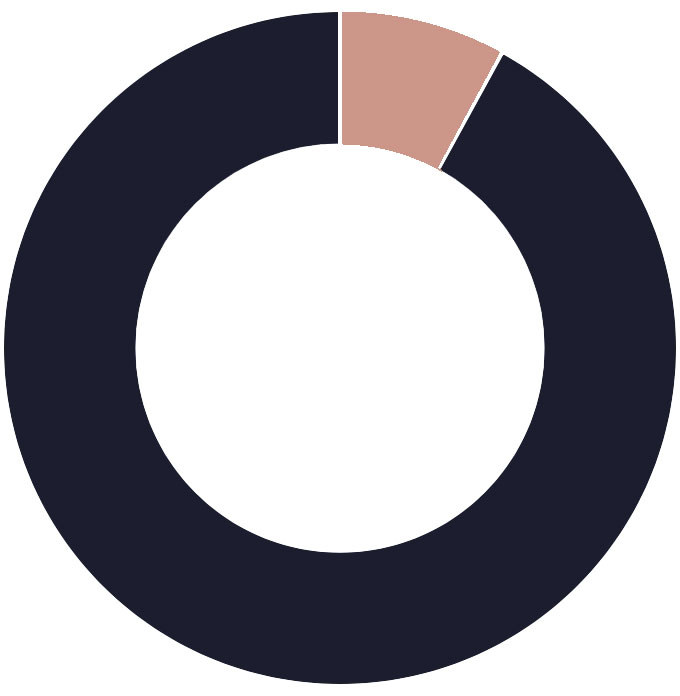

8% Risk of death before 65

16% Risk of suffering a serious illness

32% risk of being unable to work for 2 months or more

Life cover is the most popular cover, but premature death isn't the biggest risk we face during our working lives.

We're all natural optimists, but even a little bit of income protection could make your finances less of a gamble.

Source: LV= risk reality calculator May 2015, based on a male non-smoker aged 30.

Life Assurance

It’s never easy to think about what might happen after you’ve gone but, as we get older, many of us start to think about providing a financial safety net for our children and dependants in the event of our death.

We will ensure that you obtain the right cover which offers the correct level of protection at the best value for money.

Whole-of-Life Assurance

These plans are designed to run for the life of the insured, paying out a specified lump sum at the time of death.

Critical Illness

A critical illness can happen at any time. These policies are designed to pay out a lump sum upon diagnosis of any critical illness specified within the policy terms.

Income Protection

A great policy to have if you are wanting peace of mind that you have financial protection should you be sick or ill enough not to be able to work. Perfect for self-employed individuals or those with short or no sick pay benefits.

Family Income Benefit

Do you have children? This policy is designed to pay out a lump sum broken down into 12 monthly payments each year for the full term of the policy.

We also offer a range of other policies such as:

- Key Person Cover

- Mortgage Protection

- Private Medical Insurance

- Shareholder Protection or Director Share Protection

We're located in Wakefield

Athelward Suites East & West,

Estate Yard, Nostell, Wakefield,

WF4 1AB

Opening Hours

Monday - Friday: 9am - 5:30pm